Posted in Board Brief on Oct 14, 2025

THE MOST DECEPTIVE TEXT SCAMS ARE THE SIMPLEST OR CLOSEST TO REALITY.

Here are two examples:

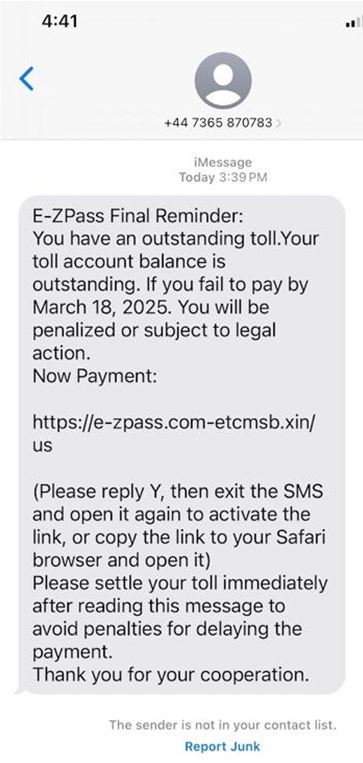

EZ Pass Scam

This Scam text is very, very deceptive because it looks legitimate and is very relevant to many New Yorkers. At least, it looks legitimate until you look closely at the link you are asked to click on (e-zpass.com-etcmsb.xin/us) and the phone number (+44 77365 870783).

You should know the official EZ-Pass URL for NY State is e-zpassny.com. The link e-zpass.com takes you to a spurious site. Also, EZ-Pass does not send texts from the United Kingdom (+44)! Delete it.

Personal Contact Scam

I...

Posted in Board Brief, KTFCU News on Sep 17, 2025

There are many types of text spam. They fall into two categories: Sales campaigns and Scams. Neither is good nor wanted.

SALES CAMPAIGNS provide offers or calls to actions.

Offers include links to insurance quotes, discount coupons, etc. Calls to action include lending opportunities, stock tips, etc. These tend to be time sensitive. They ask you to act now. Very little good can come from such marketing campaigns, because (at a minimum) responding in any way or clicking on a link carries with it a consent to Opt-In which means you will continue to get such communications.

SCAMS are more threa...

Posted in Board Brief, KTFCU News on Aug 20, 2025

Americans receive a significant amount of spam text messages daily. In February 2025, Robokiller reports indicated that Americans received 19.2 billion spam texts, according to SlickText. This translates to roughly 63 spam texts per person (which is two per day, on average). I’m sure some of you feel you get far more than two a day!

Spam texts can take many forms in that they can be from scammers or blast marketing campaigns (either from a business or consumer perspective). Either way, they are unwanted disruptions.

While email spam remains a significant problem, text spam has become arguabl...

Posted in Board Brief, KTFCU News on Jul 16, 2025

Having debt is not necessarily a problem. Spending within your means is the behavior you want to foster. Saying no to purchases you can’t afford is a hard choice, but with such hard choices brings freedom, financial freedom.

We provided statistics that show half of Americans with credit cards (100 million) use credit cards as a convenience tool. They make purchases every month and pay the full balance off each month when the balance is due. This infers they have a plan to only buy what they can pay for when the bill come due.

Of the 100 million Americans who carry a credit card balance, 25% (o...

Posted in Board Brief, KTFCU News on Jun 18, 2025

At the end of 2024, US credit card debt reached $1,210,000,000,000! That’s $1.21 trillion!

What’s worse, according to Lending Tree, 47% of Americans pay all the interest on credit card debt. JDPower says 49% of Americans pay off their credit cards monthly.

Basically, that means of the nearly 200 million people in the US who own credit cards, half are burdened with paying all the interest on credit card purchases: $130 billion per month. That debt is financed at exorbitantly high interest rates.

Financial planners say the single most important financial decision a person can make is to not have...